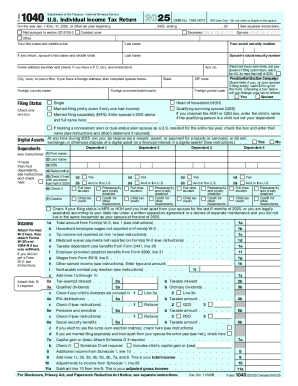

Who needs a Tax Court Petition Form?

A person filing their case in the United States Tax Court should complete a Tax Court Petition (also known as a Form 2). This form must be completed as a response to an IRS Notice of Deficiency or Notice of Determination.

This court petition could be qualified as a small tax case or a regular tax case. To be considered as a small case your petition must meet the certain dollar limits:

- The amount of your deficiency should be less than 50,000 dollars in case of an IRC Notice of Deficiency;

The amount of an unpaid tax should be less than 50,000 dollars in case of an IRC Notice of Determination Concerning Collection Action;

The amount in dispute should be less than 50,000 dollars for an IRS Notice of Worker Classification.

What is a Tax Court Petition Form for?

This petition must describe reasons and facts that justify disagreement with the IRS determination in an applicant’s case. A submitter should indicate all the mistakes they believe the IRS has made in the case.

Is a Tax Court Petition Form accompanied by other forms?

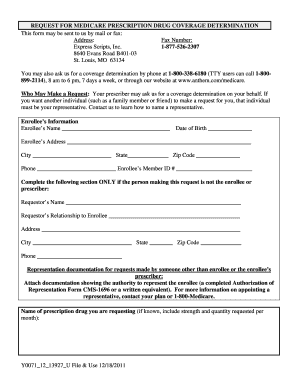

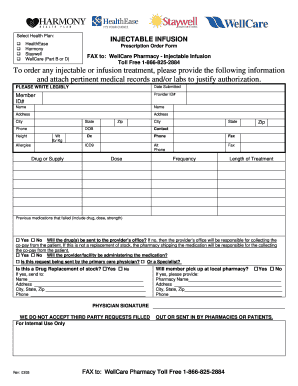

The following documents should be directed to the Court accompanying your Tax Court Petition:

- A copy of IRS Notice of Deficiency or Notice of Determination a submitter received from the IRS;

An applicant’s statement of Taxpayer Identification Number (Form 4);

A request for a place of trial (included with filler’s Tax Court Petition form);

The official fee of $60.

Please note, tax forms, receipts, or other types of tax documentation must not be attached to this Tax Petition form.

When is the Tax Court Petition Form due?

A limited time for filing this Petition is usually set by the IRS in the notice received by the taxpayer. You could check this due period as it’s stamped on the Notice of Deficiency or the Notice of Determination. Typically, the terms vary from 30 to 150 days, depending on the specifics of each case.

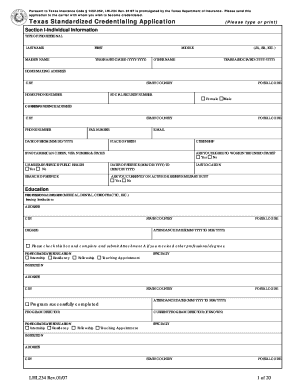

How do I fill out a Tax Court Petition Form?

First, you should indicate which IRS Notice you are going to dispute. Then you need to determine whether your Court Petition is a small tax case or not. In either case, you should complete the main block explaining why you disagree with the IRS determination. After completing your form, you must sign the petition and indicate your actual place of residence and registration address.

Where do I send the Tax Court Petition Form?

The petition must be filed with the Tax Court in Washington, D.C. at the following address: United States Tax Court, 400 Second Street, N.W. Washington, D.C. 20217-0002.